You may have noticed that your growth has stalled somewhat in the past few months. It’s kind of a worldwide thing.

You may have heard that recessions can be a great time for acquisitions… And your sources would be correct.

But did you know it can be surprisingly simple to acquire customers and businesses, for little to no money down?

Roland Frasier unpacked his 5 Rapid Customer Acquisition Strategies Guaranteed To Drive Massive Results in his session at T&C 2019.

Roland has used these strategies over and over again to scale his 24 companies:

- 17 valued at $10M or more

- 3 valued at $100M or more

- 1von the way to surpassing the $100M mark

If you want to grow companies really really fast, the trick is to take advantage of opportunities to access other people’s customers.

#1 Co-Branding with Product Integration Partnerships

This means you tap into someone else’s network of customers to build your own customer base! Check out these innovative examples:

- Domino’s Pizza

Partnered with Travel Lodge and Days Inn & Suites to place Domino’s Pizza cards in every room. Because Days Inn doesn’t offer room service, Dominos essentially became the restaurant for those hotels. - Rolls Royce, Ferrari, and Other High-End Car Companies

Partnered with Bridges Country Club in San Diego to provide a test-driving service. This allows Bridges CC to provide a unique experience for their customers, while generating high-quality leads for the car companies at zero cost.

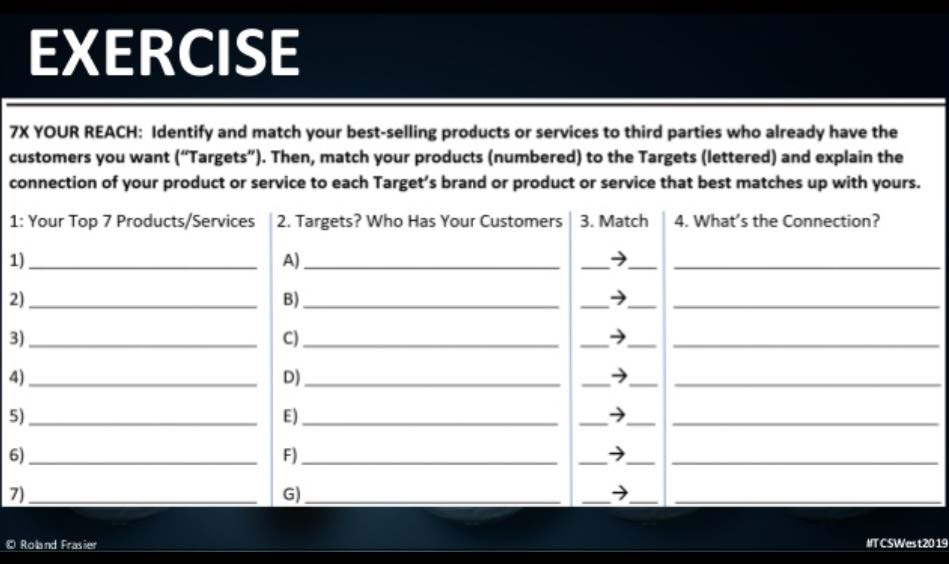

How do you know which companies to target for your partnership?

It’s all about the customer base. Laser in on the customer base you want access to, and brainstorm companies that already serve your ideal customers.

Who already has the customers you want and how can you improve the experience they provide to their customers?

Roland uses this exercise to identify opportunities for product integration partnerships:

These integration partnerships are a great way to acquire customers at a very low cost. Consider paying a flat fee or negotiating revenue share.

#2 Tap Into the Curiously Powerful Effect of Butterfly Leverage

Applying Butterfly Leverage means to take a single action and leverage it to have incredibly high impact. (Like in the movie Butterfly Effect.)

The impact Roland is talking about is monetization.

In 2019, the T&C team had their sights set on Richard Branson. We knew our audience would love him, so we wanted him for a keynote. But it was going to cost a hefty fee to his charity, and way more than we had budgeted for. So here’s what we did:

We asked ourselves, what can we do to create enough additional revenue to afford him?

- We planned a private reception at $15k per seat. When 20 people signed up to spend time with him, that generated an extra $300k in revenue!

This means we could pay the fee without going over-budget, and make our VIP speaker very happy with a generous contribution to his charity. Win-win.

2. But then we thought, how can we optimize this opportunity even more?

20 people paid $15k to spend time with Richard Branson to ask him advice and talk about their business with him. These high-ticket entrepreneurial clients were the perfect candidates for War Room Mastermind, our high-ticket business training membership.

So instead of leaving it at one reception, we hosted another reception for the same people. We created the War Room experience for them, a preview of what they would have in their membership. This led to incredible conversion opportunities.

But wait, there’s more.

3. We have this podcast called Business Lunch which seriously needed more leads in the funnel. To entice more subscribers, we created a contest to win a seat at the Richard Branson reception. We pixeled 1,522 people by giving away something of extreme value, at no additional cost, because we already committed to the payment.

4. Before bringing Richard onstage, we announced that the recording could be found on the Business Lunch Podcast, which led to 2,372 new subscribers and put us in the Top 200 Worldwide Charts.

5. When we announced Richard Branson through social media with the code SRB, 619 more tickets were sold, generating $330,000 more in revenue.

6. Social images circulated with speakers alongside Richard Branson’s headshot. Suddenly every speaker re-emailed their list and took to social saying, “Hey look! I’m sharing the stage with Richard Branson!” That sold 728 more tickets and generated about $700,000 more in revenue.

These combined efforts created an additional $1.5 million dollars. Remember, this was all generated becausewe didn’t have enough in our budget to do something amazing for our customers that they really wanted.

Branson > Reception > New Members > New Subscribers > Ticket Sales

So every time you decide on a new project, think of every possible opportunity to optimize, create additional revenue, and profit. Work the Butterfly Leverage as many times as you can. Drill down into the opportunities under each of your new ideas.

#3 Structure to “Sell the Eggs” and Keep the Goose

As business owners, we all have platforms. These platforms have tremendous momentum and can spawn assets.

DigitalMarketer spawned an asset called Traffic & Conversion Summit. Although highly valued, selling DigitalMarketer would mean losing a ton of effort and momentum. Our founders would basically have to start all over again! Instead, they sold part of T&C and kept DigitalMarketer as the media company. This means we were able to hold onto the core business!

With T&C we sold:

- The domain name

- The attendee list

- The trademark

That’s it!

We kept DigitalMarketer, War Room, and our staff. We held on to the machine that created the event, and spun off T&C only once it had its own momentum. The next time we launch another event, we can bring our machine to that deal. This is what you want: to build a machine that can incubate asset after asset, to create new things and sell them off without sacrificing your platform.

There’s another huge threat to your goose – your intellectual property.

Lots of companies keep their IP as part of their core business. This is a huge mistake.

Your Intellectual Property needs to reside in a separate company. Why?

What if something happens that creates liability for your company? If your basic company has liability and all of your IP, and someone files suit against you, you could lose your intellectual property!

When you place your IP in a separate company, your separate IP company licenses everything to your core business. This protects you in lawsuits because the core business doesn’t have any IP to lose!

But did you know that your IP can also be a golden egg of its own?

If you’re selling your operating company, hold onto that separate IP company. Then license your IP out to the new owners of the operating company. Roland tried this once, and it was a smooth and easy process. The shock came when years later, the operating company was sold again. When the new owners wanted to buy the IP associated with that company, they paid more than the price of the operating company on its original sale.

Make sure you structure your company in a way that allows you to spin off assets but keep your platform. Sell the eggs keep the goose.

#4 Scale the Most Impactful Activities, Eliminate the Least Impactful Activities, And Verticalize

When it comes to scaling your wealth and your businesses, it’s all about the exit.

If you own your company for 20 years, and it grows steadily at 8%, after 20 years you’ll have great company that’s worth 8% multiplied by the future value.

Not bad.

But if you sold a company every 5 years, that’s 4x your earnings. Let’s say the company sold for an average multiple of 7x profit. That means four times over that 20 year period, you take home seven years of income instead of one.

You could make a generation of extra income in the same amount of time.

You wouldn’t have this by simply holding onto the company for 20 years. After that, you cash out and invest at a leveraged amount to keep earning more and more. This is the magic of buying and selling.

So how do you find and leverage the right exit opportunities?

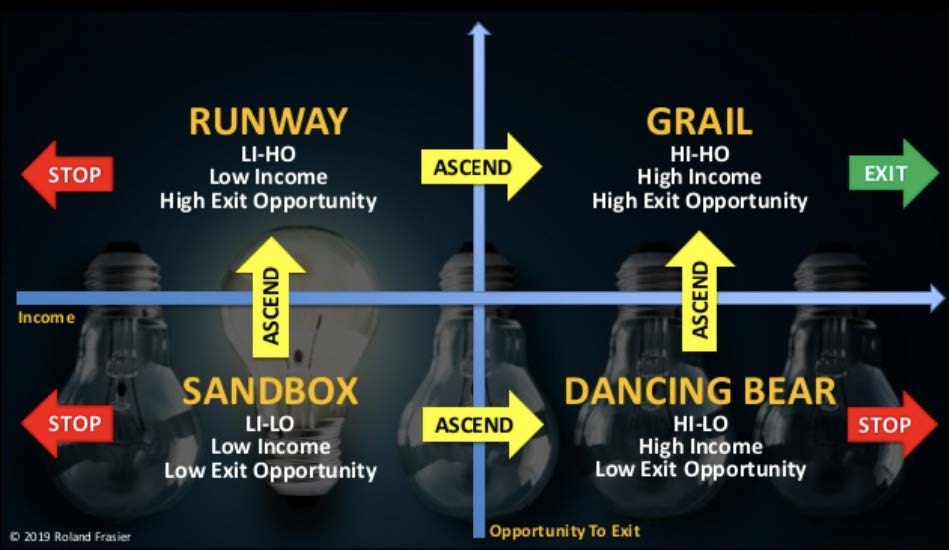

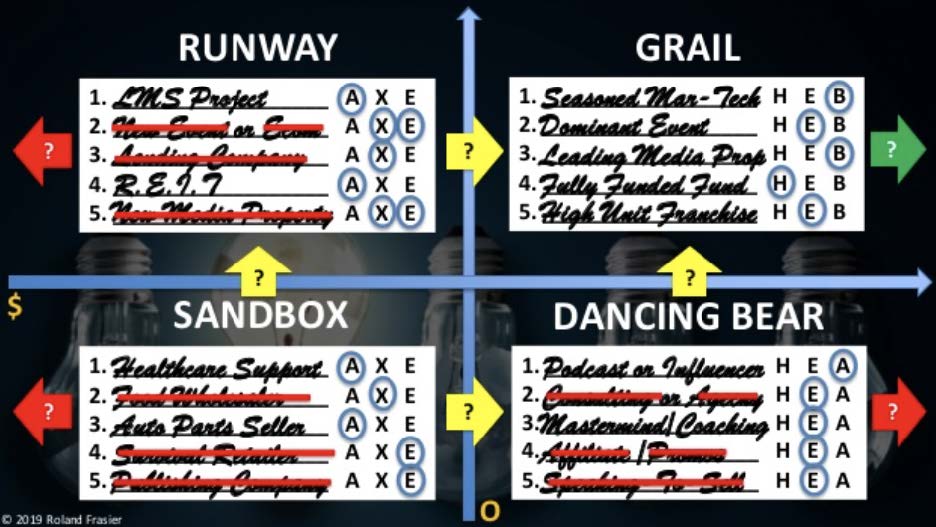

Think about the kinds of businesses you have. There are four main types:

1. Sandbox Companies: Most companies start here. They generate low income and have a low exit opportunity. The goal with a Sandbox company is to ascend into a high income, high exit opportunity.

2. Runway Companies: SaaS companies are a great example of this. They may not generate a lot of income in their early stages, but they often sell for great values. The goal with a Runway Company is to ascend into high income, high exit opportunity status.

3. Dancing Bear Companies: These are primarily for speakers, authors, experts, coaches and consultants. They generate a high income, but they’re dependent on the dancing bear. When the bear stops dancing, the money stops. This means that you can’t easily sell it. A great example of this was Tony Robbins, who had to continually write books and host events in order to generate income. But Tony came up with a great solution for his dancing bear problem. He wrote a book called Money: Master the Game which is basically a funnel to his investment fund. Because he now has $2 billion under management in that fund from his book, he’s no longer a dancing bear. He has the security to work as much or as little as he likes. The goal with Dancing Bear Companies is to do what Tony did: ascend into a high exit opportunity.

4. Grail Companies: These are the holy grail, high income and high exit opportunities.

So how do you ascend?

Chart each of your profit centers into one of these performance quadrants.

What sandbox companies do you have?

Where are you being a dancing bear?

What runway companies do you have?

Where are the grails that are headed in the right direction?

Then make a decision to ascend, kill, hold, exit or buy.

When you systemize and analyze your efforts, it helps you make good decisions. But there’s one more thing you need to consider before you eliminate or scale.

Profit & Revenue

Roland found that War Room was responsible for 42% of profit contributions for Scalable Company. Even though it only contributed 6% of the revenue for Scalable, it made sense to scale War Room with such a huge profit contribution!

Traffic and Conversion Summit was also one of the highest performing entities, at 11% revenue and 23% profit contribution. Roland immediately knew to scale both of these businesses!

Here’s what you can do:

- Chart everything that your business is doing right now.

- Compare profit and revenue contributions line-by-line.

- Eliminate anything that doesn’t contribute a significant chunk of profit or revenue.

- Focus your attention on the things that have the greatest opportunity (profit and revenue) for you.

If you want to really scale, you must eliminate under-performing assets. This opens you up to new opportunities for growth.

#5 Grow Through Acquisitions

Roland’s favorite thing in the world is to grow by acquisition. It’s easily the fastest way to grow business and wealth.

Here’s how.

Step 1: Decide What to Buy

Competitors

Buying your competition is a great way to leapfrog to the top of the industry. You essentially take them out of the market and absorb their customers. You can also acquire their assets or teams if you like!

Media

Acquiring media means new audiences, leads, and conversions. Consider grabbing up:

- Facebook groups

- YouTube accounts

- LinkedIn accounts

- Blogs

- Newspapers

Lots of media channels have massive audiences but no ability or infrastructure to monetize. You have all the funnels, products, and services to monetize, so go for it!

Teams & Resources

Want to go into software? Consider buying a company that has a software development team. You might also want to buy into resources like affiliates, customers, SOPs, or other teams like operations.

Product Vendors & Service Vendors

Who provides products and services to your business? Consider buying these vendor companies! You can pass these offers directly to your customers, and instantly have a market for them. Product examples include related products, upsell, downsell, cross-sell, substitute or supplement products. Services could include financial, business, publishing, advertising, or brokerage services.

Supply & Distribution Chain

Increase your margins by buying up manufacturing or distribution chains. This way you keep the margin they’re taking along the way. Examples could be manufacturers, suppliers, distributers, and retail sites.

Intellectual Property

Patents, customer lists, and trademarks can all do wonders to build your brand and your business.

Brainstorm in each of these categories companies that would be good candidates to advance your company!

Step 2: Buy Businesses for Nothing Down

Owner Carry

This is like real estate. You buy the company for a set price, and the sellers carry back the financing. You pay the sellers installments over a set amount of time, and you can even throw in a negotiated interest rate.

Earn Out

This is when you buy a company for some money down, and some money paid through an earn out. Based on your performance going forward, you would earn additional money. When you’re selling a company, this is a great way to get more than the buyer wants to pay. When you’re buying a company, this is a how you reduce your risk!

Swaps

Pretty simple – you swap assets or stock in your company (or other companies) that you want to buy.

Asset-Based Lending or ABL

You buy the company but then have the company pay for itself! Companies have varied assets like real estate, accounts receivable, purchase orders, etc. You can get these financed by a third-party source! You’re effectively buying it with its own assets.

Split Equity

This is just like it sounds. Divide the ownership of the company among the stakeholders moving forward.

Self-Liquidating Payments or SLiP

You agree on a payment that is equal to the amount of money that you know will come from what you can do with the company.

Baseline

Let’s say a company making $20M in sales and $3M in profits per year. Rather than pay $20M for it, you offer the first $3M that you make after acquiring the company, because that’s the income the seller is used to. That’ll be the “base line” and once you start raking in the sales, you can split the rest 50/50 with the seller until you reach the predetermined value of sale.

Pipe Wrench Offers

Are you contributing more than 10% of another company’s customers? Don’t build their brand for free! Communicate that if they want to keep seeing the free business you send them, they need to give you equity in their company.

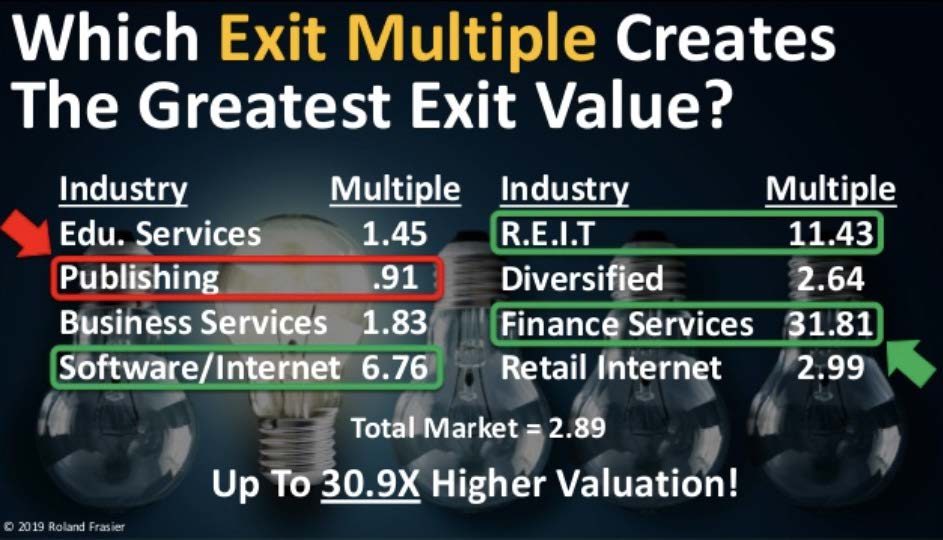

Step 3: Find the Exit Multiple for Each Profit Center

Getting acquired is also a great way to build wealth and invest at a leveraged amount.

When it comes to exits and acquisitions, the sale price will be determined by:

- Revenue

- Profit

- Multiples

- Cash to Seller

Let’s sell a company. Our example company is going to make:

$5M Revenue

$1M Profit

The sale price will vary drastically in every industry, thanks to the variety of options for multiples.

A dancing bear company, a company with no employees, or anything that is entirely remote or outsourced, is probably going to sell for seller distributable cash or seller distributable earnings. This means we’ll take the profit and multiply it by one.

($1M Profit) x (Multiple of 1) = $1M Sale

But if you have a business with multiple employees, managers, standard operating procedures, and strong customer base, you are probably going to sell for a multiple of around 7.

($1M Profit) x (Multiple of 7) = $7M Sale

That new multiple makes a huge difference! 7 is better than one, right?

Now let’s talk about SaaS companies, media companies, or anything that would sell for a multiple of revenue.

($5M Revenue) x (Multiple of 7) = $35M Sale

Crazy, right? It’s the same effort for you to complete each of these sales!

You need to find the multiple for your industry in as many places as possible.

For example, here’s DigitalMarketer’s:

As you can see, some industry multiples are way higher. Here’s how to use that to your advantage.

Step 4: Pivot Towards the Highest Exit Multiple

After you list every possible revenue multiples by industry, you need to pivot your efforts towards the highest exit multiple. Remember – this can be the difference between a $1M sale and a $35M sale!

DigitalMarketer decided to take everything that was publishing and turn it into a high exit value industry.

- We had a real estate publishing company (.91) and turned it into a Real Estate Investment Trust (11.43).

- We turned financial publishing (.91) into financial services (31.81).

- We took regular publishing (.91) and turned it into software (6.76).

Our multiple went from .91 to an average of 7.73, only because of our shift in focus.

That’s an increase of 684%!

Moving Forward

I get it. All of this — partnerships, multiplied efforts, company restructuring, cutting profit centers, negotiating acquisitions — can seem scary and overwhelming.

But here’s the thing: these strategies have been proven over and over again.

And the best part?

Massive growth doesn’t have to be expensive.

- Product Integration Partnerships can be achieved through revenue share, cost a small fee, or no cost at all!

- The Butterfly Leverage strategy turns your expenses into multiplying opportunities for revenue.

- Selling the eggs and keeping the goose means you can sell your assets without jeopardizing the machine that created them.

- Scaling exactly what works and eliminating the rest protects your resources and opens you up to new opportunities.

- Acquisitions explode your growth and can be achieved with little to no money down.

The reality is, companies that refuse to grow get left behind. In fact, stagnation (staying the same) doesn’t last long. Stagnant companies tend to fall back into to negative growth.

And with no money on the line, what have you got to lose?

Pick a strategy and START.

And if you’re ready for more…

Traffic & Conversion Summit 2020 is happening December 15 – 17 in San Diego. In 3 content-packed days, you’re not only going to get expert sessions from Ryan Deiss but also marketing legends like Marcus Lemonis, Roland Frasier, Billy Gene Shaw, Ezra Firestone, Mari Smith, Rachel Bell, Kevin Harrington, Kristen Bryant, Richard Lindner, Goldie Chan, Chalene Johnson and many more. Find out more here >>